There has been a lot of debate about India’s growth story coming to an end, with many top brokerages like Morgan Stanley and Goldman Sachs cutting GDP forecasts to sub 6% levels. However, my analysis shows India’s growth story is not only intact, it continues on a robust path.

The gloom-and-doom scenarios being painted today are an exact repeat of the phenomenon that happened during 2008-09 when the debate started that India’s growth story might be over and the Morgan Stanleys and Goldman Sachses of the world cut the GDP forecast for FY10 to sub 6% levels and some to even sub 5% levels.

What happened next?

In FY10, India posted a GDP growth rate of nearly 8%!

So what went wrong with all the doomsday scenarios for India? Two things went wrong.

First, an undue importance was placed on year-over-year (YoY) growth rates without looking at the trend in absolute GDP. That’s a simple number interpretation issue. A case in point is all the gloom surrounding the sub 6% YoY growth rates posted in the last two quarters of fiscal 2008-09 and the latest 5.3% YoY growth posted for the March 2012 quarter.

Second, not looking at the long-term trend and the impact of business cycles. That’s an economic analysis issue. Take a look at the chart below. I have compared the trend in absolute values of India GDP with that of U.S. GDP since 2005. I have compared just the India and U.S. trends in order to clearly explain how long-term growth rates and business cycles need to be interpreted. To facilitate a comparison, I have indexed the GDP values by initializing the starting values to 100.

As you can see, the chart speaks for itself. The trend in U.S. GDP is like a straight line, having grown only a total of 7% in the past six years. India GDP, on the other hand, is on a strong uptrend, having grown more than 80% in the same period. Within this long-term trend, the ups and down of a normal business cycle can clearly be seen.

Understanding long-term trends and business cycles, more often than not, does not need complex models. Most of the time simple charts and a bit of common sense work well enough. For those who would rather look at complex models, the RBI website is the right source, not brokerage research reports. There is some fantastic analysis available on the RBI site, the summary of which is that a growth rate in the 8% range is now the new normal.

Current Economic Problems: More imagined than real

The U.S. economy faces some structural issues, which are very real. Meanwhile, in India, the challenges to the long-term growth trend are more imagined than real.

The problems facing the Indian economy today are more tactical and cyclical rather than of a strategic or long-term nature. It’s not as if everything is hunky dory – no it’s not. There are challenges around fiscal deficit, current account deficits, governance and reforms. But all these challenges have pretty much existed for the past six years during which the economy continued to grow at a very healthy rate.

So, Is India’s Growth Story Intact?

As of now, yes.

As the chart clearly shows, the long-term trend in India GDP is fully intact and issues like the slowdowns in 2008 and 2011 are simply the business cycle playing itself out.

So, is there nothing that can derail the growth story? Of course, there are many factors which can do so. But it’s only major structural changes that can derail India’s growth story, things like a significant fall in competitiveness in services exports, a rollback of reforms and such like. Not factors like dollar volatility, oil prices and minor variances in fiscal deficit.

India has continued to grow at a steady pace for six years, a period characterized by a slowdown in reforms, the Lehman meltdown, dollar volatility, high fiscal deficits, high food prices and what not. Factors like these have only caused the normal ups and downs of a business cycle in India, and I forecast that they would only cause normal business cycles going forward, too.

So, What Happens Next?

In the next phase of India’s business cycle, the continuing drop in commodity prices, oil prices and interest rates will speed up the recovery process. Corporate profitability, which has already improved significantly, would post some handsome growth numbers. All these would result in a continuing GDP uptrend.

---------------------------------------------------------------------------

Related analysis

5.3% GDP: Numbers not being interpreted correctly; recovery is intact

GDP Downgrades: Be wary of research house estimates; India’s growth story intact

Party Time Again: Time to buy panic for the Sensex ride to 80,000

Hiring and Salaries Going Up: Where’s the slowdown?

Greece Paranoia: A blessing in disguise for India

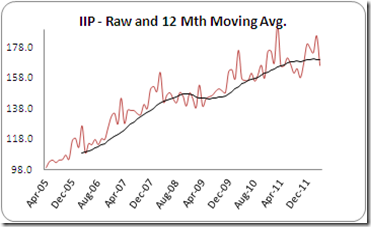

IIP Shows Recovery, Not Contraction

Recovery Underway: Fears unfounded