IIP numbers for March 2012 showed a dip of 3.5%. Economists, analysts, fund managers and a majority of the financial community were quick to raise concerns about the decline. The question is- are the IIP numbers being interpreted correctly?

I don’t believe so. I believe that IIP is tracking a very normal pattern of recovery, not one of contraction.

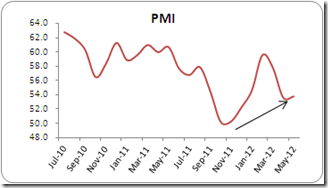

Take a look at the graphs below for IIP and PMI. Which is a better interpretation– that the economy is contracting or that it is on a slow and steady recovery path?

Now here’s another interesting take- we were in a very similar situation three years back during the 2008 - 2009 period. The current IIP data on 2011 – 2012 is tracing almost exactly the same pattern as in 2008 –2009.

This is a pattern of recovery, not of contraction. Three years back, in 2009, markets broke out of the bottoming pattern, even as IIP was tracking negative YoY numbers.