This is a repeat of a story that I did a week back. And the answer still remains, not yet. The transaction patterns of FII’s seem to show that overall they continue to remain bullish. There has been no exodus, even though they have been net sellers since April 2012. However the selling volumes are minuscule. The next few weeks will shed more light, whether FII’s will provide support or go into an exodus mode.

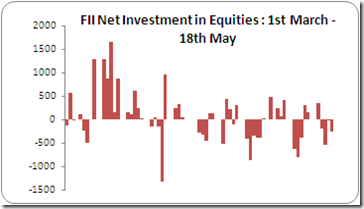

Take a look at chart below – does it look like the FII’s are in exodus mode ? I rest my case.

As the Nifty dropped by nearly a couple of hundred points from beginning of this month, FII’s have been net sellers of equities during this period. However the selling volume is minuscule.

Consider this :

Overall, for the whole of 2012, FII’s have been net buyers to the extent of Rs 38000 Cr, while being minor sellers in April (Rs 1600 Cr) and May (Rs 1200 Cr).

A few months back during Jan to March ’12 time period, when the markets were in freefall, FII’s started to provide support throughout the 4500 to 4800 range. It needs to be seen if they again step in to provide support or not.

How will we know FII’s are in exodus mode

On the other hand, how will we know if FII’s are going into a selling mode? Well, we don’t have to look too much in the past. FII’s started to exit the markets last year around Jan ‘11 – Feb’11 timeframe , right near the market tops, selling around Rs 8000 in each of those months with consistent selling on most of the days. We need to keep a close watch on FII numbers for the next few week – those tend to be better indicators than the FII interviews that are published in media.

In summary, the transaction patterns of FII’s seem to show that overall they continue to remain bullish. There has been no exodus, even though they are starting to get bearish. The next few weeks will shed more light, whether FII’s will provide support or go into an exodus mode.