An irrational fear seems to be taking over equity markets and investor sentiments. But then again, if we take a closer, more detailed look at some real data, it shows that a healthy recovery is under way and the fears are unfounded.

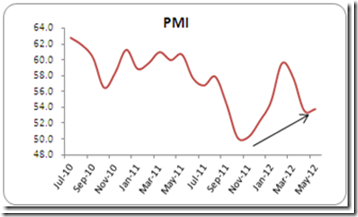

The analysis shows how key indicators like PMI, inflation, FII investments, Nifty Trends and corporate profitability all point to a healthy recovery process being underway.

And since the process of recovery is still underway, it is expected that there would be a few bumps and potholes along the way and in order for the growth to become robust, it might take a few quarters. Nonetheless, economic indicators highlight that an economic rock bottom has probably been reached and that recovery process is underway. Consider this:

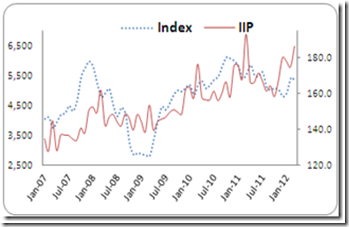

My analysis of IIP data showed how the numbers are not being interpreted correctly. IIP numbers are actually tracing a pattern of recovery, not a contraction. See the graphs below for IIP and PMI. Which is a better interpretation – that the economy is contracting OR that it is on a slow and steady recovery path?

The bottom line is that the growth story is intact and a healthy recovery is in progress. In fact, this scenario of good fundamentals combined with unjustified fears is an ideal situation for long term investments.