With fear starting to take over the stock markets on one hand, and recovery in the Indian economy progressing well on the other, this seems like a party time for professional investors to accumulate equities. After a great accumulation opportunity towards the end of last year, it seems Mr Market is offering another one on a platter.

I continue to stand by my forecast of Sensex reaching 80K (min 45K) by 2016. I made the first version of that forecast in March 2008 and have not yet seen any reasons to revise it. In fact, as part of the same forecast, I had also projected that we would go through a major bear market first, before the ride to 80,000 begins. The subsequent bear market and the lows made in October 2008 are, of course, now history.

Coming back to the present, markets are likely to continue to be spooked by the Eurozone and Greece’s minuscule economy, providing some great entry opportunities.

Investing literature, and quotes from the likes of Warren Buffett, are full of descriptions for times like these. The one I like is “Buy fear, sell greed,’’ although I don’t remember who said it (probably Buffett).

And this, to me, seems like one of those times to buy fear.

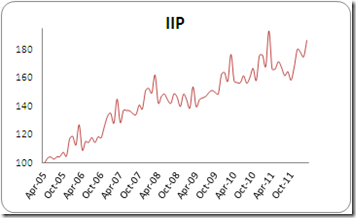

Take a look at the following charts of P/E and IIP data for the past six years. P/E’s are already in the undervalued zone and are about to enter the extreme undervaluation zone. Meanwhile, the IIP seems to be northward bound, as if the sky is the limit.

And what about global markets? Well, I believe the long-term professional investor must be looking at a time frame of seven years or more. In that time frame, does it make a difference whether the Eurozone remains or melts down, let alone Greece?

Even from a short-term perspective of the next year or so, my analysis shows that global recovery is intact. This notwithstanding the latest PMI numbers for the U.S., China and the Eurozone released today, which on a superficial basis might cause further fear. A deeper analysis reveals the recovery is intact.

Coming back to the projection of 80,000 (minimum 45,000) for the Sensex, that number, is really not that terribly large, if we keep in mind that the Sensex was at around 3,000 just a decade back and at around 6,000 about seven years back. As for growth estimates, I am not even banking on a 10% range of GDP growth and a 20% range of EPS growth. My growth estimates are far more conservative, but that is probably better covered in another story.

I’ll end this story with another one of those nice quotes: “What we learn from history is that people don’t learn from history.”